WooCommerce EU VAT Assistant wordpress plugin resources analysis

| Download This Plugin | |

| Download Elegant Themes | |

| Name | WooCommerce EU VAT Assistant |

| Version | 1.3.12.150306 |

| Author | Aelia (Diego Zanella) |

| Rating | 100 |

| Last updated | 2015-03-06 07:50:00 |

| Downloads |

704

|

| Download Plugins Speed Test plugin for Wordpress | |

Home page

Delta: 0%

Post page

Delta: 0%

Home page PageSpeed score has been degraded by 0%, while Post page PageSpeed score has been degraded by 0%

WooCommerce EU VAT Assistant plugin added 15 bytes of resources to the Home page and 17 bytes of resources to the sample Post page.

WooCommerce EU VAT Assistant plugin added 0 new host(s) to the Home page and 0 new host(s) to the sample Post page.

Great! WooCommerce EU VAT Assistant plugin ads no tables to your Wordpress blog database.EU VAT Assistant for WooCommerce is designed to help achieving compliance with the new European VAT regulations, coming into effect on the 1st of January 2015. Starting from that date, digital goods sold to consumers in the European Union are liable to EU VAT, no matter where the seller is located. The VAT rate to apply to each sale is the one charged in the country of consumption, i.e. where the customer resides. These new rules apply to worldwide sellers, whether resident in the European Union or not, who sell their products to EU customers. For more information: EU: 2015 Place of Supply Changes - Mini One-Stop-Shop.

This is a full version of the premium EU VAT Assistant plugin, developed by Aelia Team - The WooCommerce multi-currency experts, provided free of charge. You can use it as you like, and we hope it will make it easier for you to deal with the new, complex EU VAT regulations. If you would like to avail of our support service, we would like to invite you to buy the paid version, which includes full support through our dedicated portal.

Important

- Please make sure that you read the requirements below before installing this plugin.

- You must install our AFC plugin for WooCommerce for the EU VAT Assistant to work.

How this product works

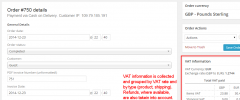

The EU VAT Assistant plugin extends the standard WooCommerce sale process and calculates the VAT due under the new regime. The information gathered by the plugin can then be used to prepare VAT reports, which will help filing the necessary VAT/MOSS returns.

The EU VAT Assistant plugin also records details about each sale, to prove that the correct VAT rate was applied. This is done to comply with the new rules, which require that at least two pieces of non contradictory evidence must be gathered, for each sale, as a proof of customer's location. The evidence is saved automatically against each new order, from the moment the EU VAT compliance plugin is activated.

In addition to the above, the plugin includes powerful features to minimise the effort required to achieve compliance, such as the validation of EU VAT numbers for B2B sales, support for customer's self-certification of location, automatic update of exchange rates, etc. Please refer to the Key Features section, below, for more details.

Key Features

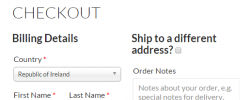

- Accepts and validates EU VAT numbers, applying VAT exemption when appropriate. Validation of European VAT numbers is performed via the official VIES service, provided by the European Commission. This feature is equivalent to the one provided by the EU VAT Number plugin.

- Supports a dedicated VAT currency, which is used to generate the reports. You can sell in any currency you like, the EU VAT Assistant plugin will take care of converting the VAT amounts to the currency you will use to file your returns.

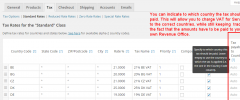

- Supports mixed products/services scenarios. The new EU VAT MOSS regime applies to the sale of digital products and services that do not require significal manual intervention. Sale of services that are provided with human intervention, such as support, consultancy, design, are still subject to VAT at source. In this case, VAT has to be paid to the revenue in merchant's country. WooCommerce allows to specify to which country a tax applies, but not to which country it should be paid once collected. The EU VAT Assistant can help, by allowing merchants to specify the "payable to" country for each VAT. Such information is then displayed in the VAT reports.

- Allows to force B2B or B2C sales. You can decide if you wish to force customers to a valid EU VAT number at checkout, thus accepting only B2B transactions, or prevent them from doing it, thus accepting only B2C transactions.

- Allows to prevent sales to specific countries. You can exclude some countries from the list of allowed ones, thus preventing customers from those countries from placing an order.

- Fully compatible with our products, such the WooCommerce Currency Switcher, Prices by Country, Tax Display by Country and Prices by Role (coming soon).

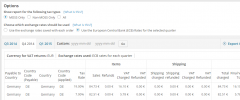

- Automatically updates the exchange rates that are be used to produce the VAT reports in the selected VAT currency. The plugin can fetch exchange rates from the following providers:

- European Central Bank

- HM Revenue and Customs service

- Bitpay

- Irish Revenue (experimental)

- Danish National Bank (sponsored by Asbjoern Andersen).

- Calculates and stores the VAT amounts automatically, for each order.

- Collects evidence required by the new regulations, to prove that the correct VAT rate was applied. The plugin can automatically detect customer's location, thus gathering one of the approved pieces of evidence.

- Allows to collect a self-certification from the customer, when insufficient evidence is available to prove his/her location.

- Automatically populates the VAT rates for all EU countries in WooCommerce Tax Settings.

- Includes integration with PDF Invoices and Packing Slips plugin, to automatically generate EU VAT-compliant invoices. Documentation coming soon.

- Reports

- EU VAT report by Country.

- Sales by Country (in development).

- Support for ECB exchange rates in reports. VAT Reports can use either the exchange rate saved with each order, or the European Central Bank rate required to produce the official VAT MOSS returns (ref. official documentation). This feature will allow you to use the EU VAT Assistant to produce both your domestic VAT return and the VAT MOSS return.

Requirements

- WordPress 3.6 or later.

- PHP 5.3 or later.

- WooCommerce 2.1.x/2.2.x/2.3.x.

- AFC plugin for WooCommerce 1.4.9.150111 or later.

Disclaimer

This product has been designed to help you fulfil the requirements of the following new EU VAT regulations:

- Identify customers' location.

- Collect at least two non-contradictory pieces of evidence about the determined location.

- Apply the correct VAT rate.

- Ensure that VAT numbers used for B2B transactions are valid before applying VAT exemption.

- Collect all the data required to prepare VAT returns.

We cannot, however, give any legal guarantee that the features provided by this product will be sufficient for you to be fully compliant. By using this product, you declare that you understand and agree that we cannot take any responsibility for errors, omissions or any non-compliance arising from the use of this plugin, alone or together with other products, plugins, themes, extensions or services. It will be your responsibility to check the data produced by this product and file accurate VAT returns on time with your Revenue authority. For more information, please refer to our terms and conditions of sale and support.