WooCommerce EU VAT Compliance wordpress plugin resources analysis

| Download This Plugin | |

| Download Elegant Themes | |

| Name | WooCommerce EU VAT Compliance |

| Version | 1.8.0 |

| Author | David Anderson |

| Rating | 100 |

| Last updated | 2015-03-05 03:53:00 |

| Downloads |

4130

|

| Download Plugins Speed Test plugin for Wordpress | |

Home page

Delta: 0%

Post page

Delta: 0%

Home page PageSpeed score has been degraded by 0%, while Post page PageSpeed score has been degraded by 0%

WooCommerce EU VAT Compliance plugin added 4 bytes of resources to the Home page and 3 bytes of resources to the sample Post page.

WooCommerce EU VAT Compliance plugin added 0 new host(s) to the Home page and 0 new host(s) to the sample Post page.

Great! WooCommerce EU VAT Compliance plugin ads no tables to your Wordpress blog database.The New EU VAT (IVA) law

From January 1st 2015, all digital goods (including electronic, telecommunications, software, ebook and broadcast services) sold across EU borders are liable under EU law to EU VAT (a.k.a. IVA) charged in the country of purchase, at the VAT rate in that country (background information: http://www2.deloitte.com/global/en/pages/tax/articles/eu-2015-place-of-supply-changes-mini-one-stop-shop.html). This applies even if the seller is not based in the EU, and there is no minimum threshold.

How this plugin can take away the pain

This WooCommerce plugin provides features to assist with EU VAT law compliance from January 1st 2015. Currently, those features include:

Identify your customers' locations: this plugin will record evidence of your customer's location, using their billing or shipping address, and their IP address (via a GeoIP lookup).

Forbid EU sales if any goods have VAT chargeable - for shop owners for whom EU VAT compliance is too burdensome, this feature will allow you to forbid EU customers to check-out if they have selected any goods which are subject to EU VAT (whilst still allowing purchase of other goods, unlike the built-in WooCommerce feature which allows you to forbid check-out from some countries entirely).

Evidence is recorded, ready for audit: full information that was used to calculate VAT and customer location is displayed in the WooCommerce order screen in the back-end.

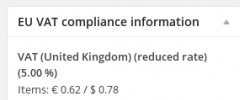

Display prices including correct VAT from the first page: GeoIP information is also used to show the correct VAT from the first time a customer sees a product. A widget and shortcode are also provided allowing the customer to set their own country (whole feature requires WooCommerce 2.2.9 or later).

Currency conversions: Most users (if not everyone) will be required to report VAT information in a specific currency. This may be a different currency from their shop currency. This feature causes conversion rate information to be stored together with the order, at order time. Currently, three official sources of exchange rates are available: the European Central Bank (ECB), the Danish National Bank, the Central Bank of the Russian Federation, and HM Revenue & Customs (UK).

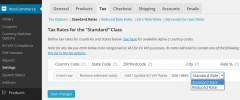

Entering and maintaining each country's VAT rates: this plugin assists with entering EU VAT rates accurately by supplying a single button to press in your WooCommerce tax rates settings, to add or update rates for all countries (standard or reduced) with one click.

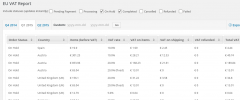

Reporting: Advanced reporting capabilities, allowing you to see all the information needed to make a MOSS (mini one-stop shop) VAT report. The report is sortable and broken down by country, VAT rate, VAT type (traditional/variable) and order status.

Central control: brings all settings, reports and other information into a single centralised location, so that you don't have to deal with items spread all over the WordPress dashboard.

Mixed shops: You can sell goods subject to EU VAT under the 2015 digital goods regulations and other physical goods which are (until 2016) subject to traditional base-country-based VAT regulations. The plugin supports this via allowing you to identify which tax classes in your WooCommerce configuration are used for 2015 digital goods items. Products which you place in other tax classes are not included in calculations/reports made by this plugin for per-country tax liabilities, even if VAT was charged upon them. (For such goods, you will calculate how much you owe your local tax-man by using WooCommerce's built-in tax reports).

Distinguish VAT from other taxes: if you are in a jurisdiction where you have to apply other taxes also, then this plugin can handle that: it knows which taxes are EU VAT, and which are not.

Add line to invoices: If VAT was paid on the order, then an extra, configurable line can be added to the footer of the PDF invoice (when using the the free WooCommerce PDF invoices and packing slips plugin).

A Premium version is on sale at this link, and currently has these additional features ready:

VAT-registered buyers can be exempted, and their numbers validated: a VAT number can be entered at the check-out, and it will be validated (via VIES). Qualifying customers can then be exempted from VAT on their purchase, and their information recorded. This feature is backwards-compatible with the old official WooCommerce "EU VAT Number" extension, so you will no longer need that plugin, and its data will be maintained. The customer's VAT number will be appended to the billing address where shown (e.g. order summary email, PDF invoices). An extra, configurable line specific to this situation can be added to the footer of the PDF invoice (when using the the free WooCommerce PDF invoices and packing slips plugin).

Optionally allow B2B sales only - for shop owners who wish to only make sales that are VAT-exempt (i.e. B2B sales only), you can require that any EU customers enter a valid EU VAT number at the check-out.

CSV download: A CSV containing comprehensive information on all orders with EU VAT data can be downloaded (including full compliance information). Manipulate in your spreadsheet program to make arbitrary calculations.

Non-contradictory evidences: require two non-contradictory evidences of location (if the customer address and GeoIP lookup contradict, then the customer will be asked to self-certify his location, by choosing between them).

Show multiple currencies for VAT taxes on PDF invoices produced by the free WooCommerce PDF invoices and packing slips plugin.

Support for the WooCommerce subscriptions extension

Read more about the Premium version of this plugin at this link.

Other features are still being weighed up and considered. It is believed (but not legally guaranteed), that armed with the above capabilities, a WooCommerce shop owner will be in a position to fulfil all the requirements of the EU VAT law: identifying the customer's location and collecting multiple pieces of evidence, applying the correct VAT rate, validating VAT numbers for B2B transactions, and having the data needed to create returns. (If in the EU, then you will also need to make sure that you are issuing your customers with VAT invoices containing the information required in your jurisdiction, via a suitable WooCommerce invoice plugin).

Before January 1st 2015, of course, you will want to be careful about which features you enable. Before that date, the previous VAT / IVA regime will continue to operate.

Footnotes and legalese

This plugin is tested on WooCommerce 2.1 up to 2.3 (releases up to 1.7.1 were also tested on WC 2.0). It fetches data on current VAT rales from Amazon S3 (using SSL if possible); or, upon failure to connect to Amazon S3, from https://euvatrates.com. If your server's firewall does not permit this, then it will use static data contained in the plugin.

Geographical IP lookups are performed via WooCommerce's built-in geo-location features (WC 2.3+), or if on WC 2.2 or earlier then via the MaxMind GeoIP database via the GeoIP-plugin, which you will be prompted to install; or, alternatively, if you use CloudFlare, then you can activate the CloudFlare feature for sending geographical information.

Please make sure that you review this plugin's installation instructions and have not missed any important information there.

Please note that, just as with WordPress and its plugins generally (including WooCommerce), this plugin comes with no warranty of any kind and you deploy it entirely at your own risk. Furthermore, nothing in this plugin (including its documentation) constitutes legal or financial or any other kind of advice of any sort. In particular, you remain completely and solely liable for your own compliance with all taxation laws and regulations at all times, including research into what you must comply with. Installing any version of this plugin does not absolve you of any legal liabilities, or transfer any liabilities of any kind to us, and we provide no guarantee that use of this plugin will cover everything that your store needs to be able to do.

Whether you think the EU's treaties with other jurisdictions will lead to success in enforcing the collection of taxes in other jurisdictions is a question for lawyers and potential tax-payers, not for software developers!

Many thanks to Diego Zanella, for various ideas we have swapped whilst working on these issues. Thanks to Dietrich Ayala, whose NuSOAP library is included under the LGPLv2 licence.

Other information

Some other WooCommerce plugins you may be interested in: https://www.simbahosting.co.uk/s3/shop/

This plugin is ready for translations (English, Finnish, French and German are currently available), and we would welcome new translations (please post them in the support forum; the POT file is here, or you can contact us and ask for a web-based login for our translation website).